More UK Bank Cards Now Show Account Balance in Apple Wallet

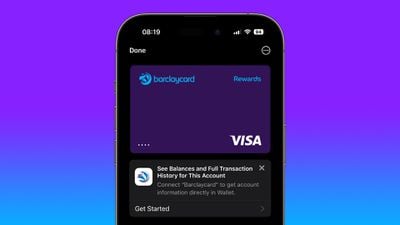

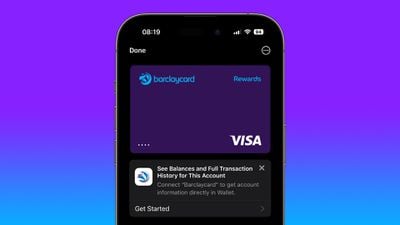

Apple in iOS 17.1 began allowing iPhone users in the UK to view the account balances of select bank cards and credit cards in the Wallet app, and now several more banks have added support for the feature.

Apple added the transaction and card balance functionality to the Wallet app in October as part of its Connected Cards feature, but initially only a handful of bank cards were compatible.

According to Apple's updated support document, account balance and full transaction history viewing now works with cards from Barclays, Barclaycard, First Direct, Halifax, HSBC, Lloyds, M&S Bank, Monzo Bank, NatWest Bank, and Royal Bank of Scotland.

UK banks support the Open Banking API to integrate with the Wallet app, which made the feature widely available to UK users from the off, but the Connected Cards rollout in the United States has been slower.

Following the release of the feature, MacRumors discovered that code in iOS 17.1 and references on Apple's website suggested that the feature would expand to the US, which turned out to be accurate. For example, users of Discover cards were first to see the option to view their total card balance and transaction history in Apple Wallet.

Note that if you don't see the option to Get Started below your card in the Wallet app, your card issuer currently isn't eligible.

Popular Stories

Apple plans to announce the iPhone 17e on Thursday, February 19, according to Macwelt, the German equivalent of Macworld.

The report, citing industry sources, is available in English on Macworld.

Apple announced the iPhone 16e on Wednesday, February 19 last year, so the iPhone 17e would be unveiled exactly one year later if this rumor is accurate. It is quite uncommon for Apple to unveil...

Apple turns 50 this year, and its CEO Tim Cook has promised to celebrate the milestone. The big day falls on April 1, 2026.

"I've been unusually reflective lately about Apple because we have been working on what do we do to mark this moment," Cook told employees today, according to Bloomberg's Mark Gurman. "When you really stop and pause and think about the last 50 years, it makes your heart ...

Apple today shared an ad that shows how the upgraded Center Stage front camera on the latest iPhones improves the process of taking a group selfie.

"Watch how the new front facing camera on iPhone 17 Pro takes group selfies that automatically expand and rotate as more people come into frame," says Apple. While the ad is focused on the iPhone 17 Pro and iPhone 17 Pro Max, the regular iPhone...

In the iOS 26.4 update that's coming this spring, Apple will introduce a new version of Siri that's going to overhaul how we interact with the personal assistant and what it's able to do.

The iOS 26.4 version of Siri won't work like ChatGPT or Claude, but it will rely on large language models (LLMs) and has been updated from the ground up.

Upgraded Architecture

The next-generation...

While the iOS 26.3 Release Candidate is now available ahead of a public release, the first iOS 26.4 beta is likely still at least a week away. Following beta testing, iOS 26.4 will likely be released to the general public in March or April.

Below, we have recapped known or rumored iOS 26.3 and iOS 26.4 features so far.

iOS 26.3

iPhone to Android Transfer Tool

iOS 26.3 makes it easier...